Rates try a vital basis to adopt when you take a loan out-of 401(k) Fidelity, as they affect the total price off borrowing from the bank and you can payment personal debt. Interest percentage is calculated considering particular standards.

The speed Weldona payday loans no bank account to the an excellent 401(k) Fidelity financing is usually linked with the top rate, and this functions as a benchmark. A higher interest is also rather enhance the number paid more the loan term, affecting all round economic health of debtor.

Things impacting the interest rate devotion include the borrower’s credit rating, market requirements, and loan name. Focusing on how interest is calculated while the implications he’s on the financing payment is very important in making informed monetary behavior when offered financing away from 401(k) Fidelity.

The procedure of bringing that loan out-of 401(k) Fidelity pertains to multiple sequential measures. They might be examining eligibility, deciding the mortgage count, doing the program, examining words, and you can entry new request.

While the private has established qualifications and understood the necessary mortgage count, the next thing is to help you complete the applying provided because of the 401(k) Fidelity. This form generally demands personal data, factual statements about the loan, and you may agreement toward small print established.

Immediately following finishing the shape, it is essential to very carefully opinion all fine print in order to make certain a definite understanding of the payment conditions, rates of interest, and you may people associated costs. Upon guaranteeing all guidance, the application are published to initiate the loan control techniques.

Check Mortgage Eligibility

In advance of continuing that have a software, it is crucial to assess the eligibility having a beneficial 401(k) Fidelity financing. This includes offered factors for example recognition criteria, eligibility criteria, and financing availableness.

So you can qualify for a loan in your 401(k) Fidelity account, you are going to basically have to have an effective vested equilibrium regarding the plan, meet up with the minimal many years requirement, and never have any the funds regarding account.

The loan acceptance could be dependent on the terms and you can requirements place by Fidelity for including funds, for instance the limitation financing limitation and you can payment terminology.

Knowledge such qualifications things as well as the offered financing choices inside your 401(k) account helps you make an informed decision regarding your financial demands.

Determine Amount borrowed

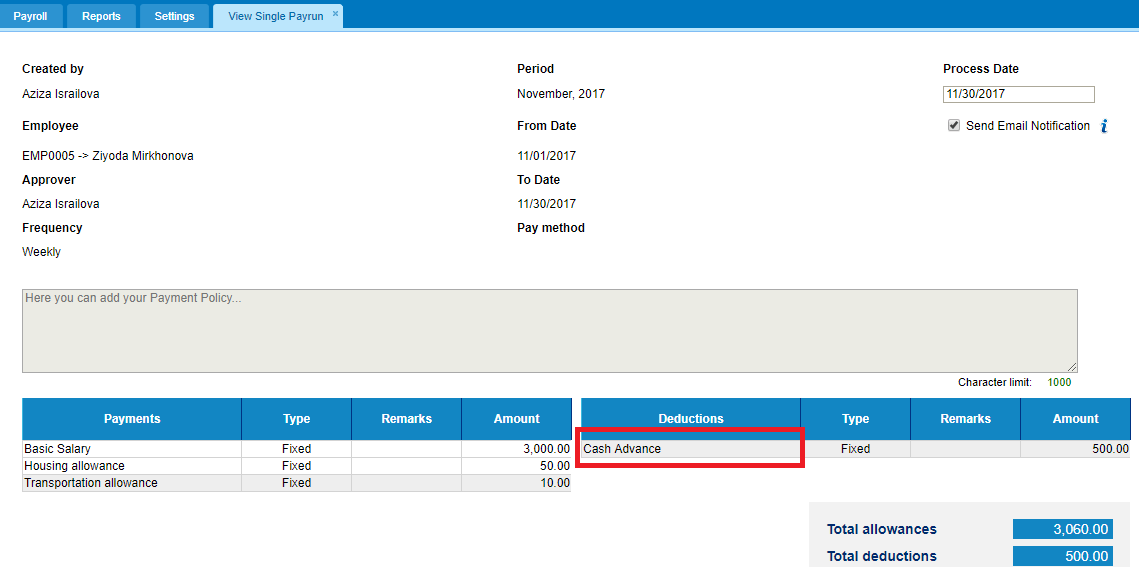

ount was a life threatening part of the new 401(k) Fidelity borrowing from the bank techniques, whilst decides the purpose wherein the funds would be made use of therefore the measures wherein the borrowed funds was paid.

Deciding the optimal loan amount pertains to an innovative attention of your own monetary needs and you will restrictions. Knowing the designed purposes for the borrowed funds will assist individuals evaluate how much they really want.

Evaluating the disbursement actions given by lending organizations could affect this new decision-making processes. Many people get choose a lump sum disbursement, while some you will choose for unexpected money. It is also essential to cause for any limitations regarding how the brand new loan can be used, making sure it aligns on economic goals and objectives put by borrower.

Done Loan application

Finishing the loan app for a good 401(k) Fidelity mortgage means adherence to help you a specified schedule, submission off called for documentation, and selection of prominent fees alternatives.

Whenever filling out the application, make certain that all of the required fields was complete precisely, and personal data, a job information, therefore the loan amount asked.

This new entry schedule normally range out of a few days to help you a good couple of weeks, with regards to the difficulty of the mortgage. Be ready to promote help data for example pay stubs, lender statements, and you can identity to ensure their eligibility.

Pursuing the application is filed, you will have the opportunity to select from certain cost alternatives, for example monthly premiums, automatic deductions, otherwise lump-contribution payments for the financial choices.